What is VAT?

What is VAT?

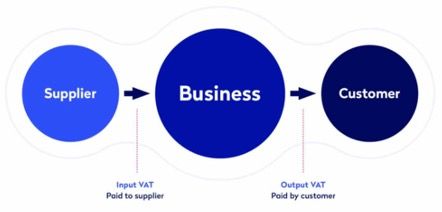

VAT is a general consumption tax assessed on the value added to goods and services. It is seen as a consumption tax because it is ultimately borne by the final consumer rather than businesses. VAT is charged through the supply chain with most businesses being able to claim a credit for the VAT paid at an earlier stage. The VAT on sales is called output VAT. The VAT incurred on purchases is called input VAT.

Example:

Manufacturing Co makes clothes and sells them to Distribution Co for £1000 plus VAT of £200. This VAT is paid to the tax authority. Distribution Co sells to Retail Co for £1400 plus VAT of £280. This VAT is due to the tax authority, but they can offset the £200 charged by Manufacturing Co. Let’s assume these are the only transactions in Distribution Co’s VAT return so they have VAT on sales of £280 and VAT on purchases of £200. Therefore, they only pay £80 to the tax authority.

Retail Co sells these products to lots of customers and has income from these sales of £2040. As retailers typically sell inclusive of VAT, they must report VAT of £340 (VAT taken from the sales rather than added). As they can claim back the £280 VAT charged by Distribution Co, they only have VAT of £60 to pay to the tax authority.

The customers cannot reclaim the VAT they paid for the clothes as they are not registered for VAT so the tax authority ‘gains’ the £60 to fund…well a bit of everything really!

How do we apply it?

VAT and GST are common in many countries around the world. They all have very similar rules but with local variations. Even the countries of the EU that have the EU VAT Directive have local VAT laws which differ. When determining whether VAT is due on a transaction, we must consider the following:

· What are we selling?

· Who are we selling it to?

· Where are they located?

· What is the value?

· Is it via a marketplace?

The reason these questions are important is because VAT rules differ based on whether the buyer is a business or consumer, whether they are local or international and whether the product is subject to the standard or any reduced rates or has any other special VAT rules.

Please get in touch if you need support identifying whether VAT applies to your sales or not. Get in touch